July 21, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Bitcoin dropped below $29K for the first time in a month on Tuesday.

- OpenSea, an NFT marketplace, raised $100M in a Series B valuing the company at $1.5B.

- 70% of institutional investors expect to invest/buy digital assets in the future, according to a study by Fidelity.

- Silvergate Bank accepted $4.3B in new deposits from digital currency investors in Q2 2021.

- SushiSwap unveiled four new products at the Ethereum Paris conference that will allow users to build their own liquidity pools.

- CoinFund’s $83M venture fund will be focused on DeFi and NFT projects.

- Titan, an investment manager with a new crypto tool rolling out August 3, announced a $58M raise led by a16z.

- MakerDAO is now under the control of a DAO.

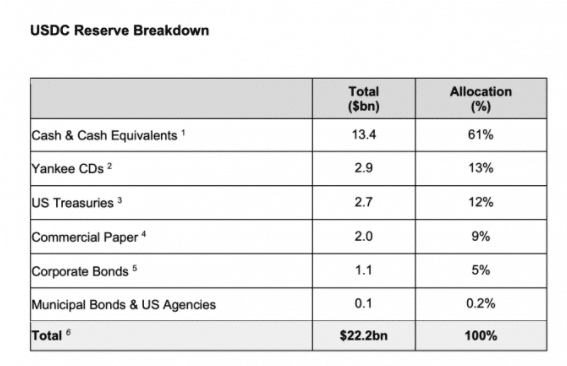

- Circle revealed that 61% of USDC reserves are made up of cash or cash equivalents.

What Do You Meme?

What’s Poppin’?

Yesterday, the cryptocurrency exchange FTX announced a $900 million funding round at an $18 billion valuation. Over 60 investors participated in the raise, including Sequoia, Paradigm, SoftBank, Third Point, Multicoin Capital, amongst others. According to data compiled by The Block, the raise represents the largest funding round in crypto investment history.

The Sam Bankman-Fried led company has seen explosive growth since its launch in May 2019. Based on FTX’s press release, the exchange’s revenue has increased tenfold YTD and a whopping 75X since last early 2020. Additionally, the company now has over 1 million users and averages $10B in daily trading volume.

Per FTX’s official Twitter account, the near billion influx of cash will immediately be put to use… purchasing the “fanciest bean bag” available.

You can learn more about FTX’s raise here, here, and here.

Recommended Reads

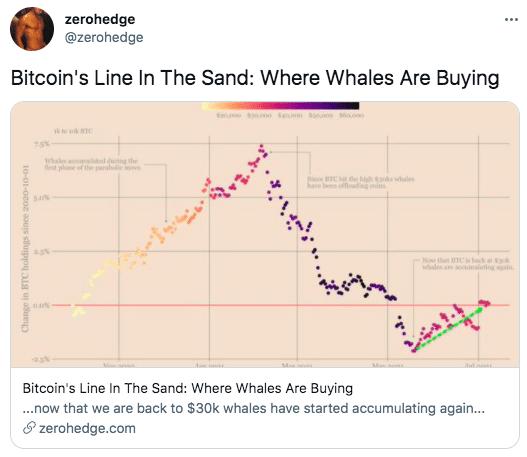

- Zero Hedge on where BTC whales are making purchases:

- Thinking of joining a decentralized autonomous organization? Just DAO it (there are tons of options)…

- Drew Hinkes with an in-depth legal breakdown of smart contracts and DAOs:

On The Pod…

How Ransomware Evolved Into a Big Business

Gurvais Grigg, Chainalysis public sector CTO, and Kim Grauer, director of research at Chainalysis, review the ransomware landscape. Show Highlights:

-

their backgrounds and roles at Chainalysis

-

how a ransomware attack works

-

what types of businesses are usually targeted in ransomware attacks

-

why ransomware as a service (RAAS) is a booming business

-

why Kim and Gurvais believe the hacking group REvil is becoming more sophisticated

-

what characteristic of REvil hints that the group could be affiliated with Russia

-

how the RAAS business model works

-

how ransomware payments can be tracked

-

why ransomware reporting has a data problem

-

why Bitcoin is the preferred method of payment amongst ransomware attackers

-

what two factors makes BTC preferable to privacy coins

-

how ransomware groups teach victims to transfer BTC

-

how ransomware groups cash out of their BTC

-

how counter-terrorism tactics can help fight ransomware attacks

-

how the Department of Justice may have partially recovered part of the Colonial Pipeline ransomware payment

-

what tools and strategies governments can and will use to battle ransomware

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians