October 21, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin hit a new ATH above $66K.

-

Revolut, a trading app, will not charge crypto trading fees for US customers.

-

Ethereum topped $4,000 for the first time since May.

-

Paul Tudor Jones said that Bitcoin is “winning the race against gold.”

-

Total value locked in DeFi protocols crossed $100 billion for the first time.

-

Twitter CEO Jack Dorsey nearly predicted the block that would hold Bitcoin’s latest ATH.

-

Crypto investment firm Digital Currency Group announcedthe purchase of $388 million worth of the Grayscale Bitcoin Trust (GBTC) shares as GBTC continues to trade at a discount.

-

Flow Blockchain, the network behind NBA Top Shot and CryptoKittiies, claims that 68% of nodes on the blockchain are run by the community.

-

Western Union was downgraded by BTIG, an investment bank, due to concerns of competition from Strike, a Lightning Network company.

-

Stronghold Digital Mining stock jumped 52% on its first day of trading.

-

Australian regulators presented a report outlining recommendations that would bring clarity to digital asset regulation in the country.

-

Hindenburg Research is offering a $1 million bounty for undisclosed information regarding Tether’s backing.

-

Wormhole, a cross-chain bridge, added support for Terra.

-

A one-of-one Wu-Tang Clan album now belongs to a DAO.

-

FTM, the native token of the layer 1 platform Fantom, nearly doubled over the last 30 days.

Clarification: Yesterday, Unchained reported that the New York State Attorney General sent letters to two unnamed crypto lenders to stop operating within the state. Unchained reported that the two companies were assumed to be Nexo and Celsius, based on documents in the filing. However, since yesterday’s newsletter, Celsius published a blog stating that the company had “not received a cease and desist order in NY.”

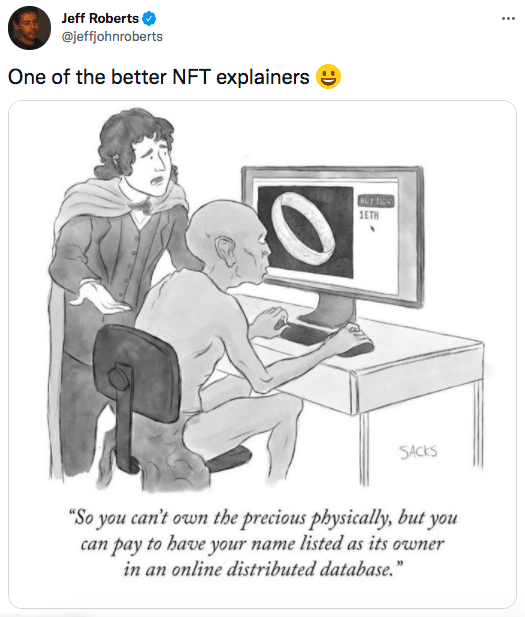

What Do You Meme?

What’s Poppin’?

With Bitcoin reaching a new all-time high and Ethereum crossing $4,000, it appears that the crypto industry has once again caught the attention of institutional participants. For example, just yesterday, two large financial institutions made headlines in the crypto space.

First, Cboe Global Markets, where over $75 billion in US Equities are traded daily, announced the acquisition of ErisX, a digital asset exchange that offers spot and futures products through a regulated clearing house. Under the new deal, ErisX will be rebranded to Cboe Digital.

Ed Tilly, Chairman, president and CEO of Cboe Global Markets, said: “We believe our acquisition of ErisX, coupled with broad industry participation and support, will help us bring the regulatory framework, transparency, infrastructure and data solutions of traditional markets to the digital asset space.”

Interestingly, while Cboe described the acquisition as “entering” the digital asset space. However, the more apt description would be a reentry, as the exchange previously offered bitcoin futures from 2017- 2019.

Cboe’s announcement comes on the same day that ProShare’s bitcoin futures ETF, $BITO, became the fastest ETF to reach $1 billion in assets. Additionally, the SEC approved two bitcoin futures ETFs to be issued by Valkyrie and VanEck, which will be launched in the next few days. With Cboe’s reentry, investors will have a variety of ways to gain exposure to Bitcoin through regulated futures-based Bitcoin products.

Secondly, Pimco, a $2 trillion investment firm, made headlines after an exec told CNBC that the company could potentially invest in cryptocurrency. Daniel Ivascyn, chief investment officer at Pimco, said, “Now we’re looking at potentially trading certain cryptocurrencies as part of our trend-following strategies or quant-oriented strategies, then doing more work on the fundamental side.”

Recommended Reads

- Token Terminal on how the crypto market has grown since 2017:

- Messari’s Nick Garcia on Polkadot’s parachain auctions:

- @CroissantEth on stablecoins:

On The Pod…

Is the Metaverse Already Here? Two Experts Disagree

Andrew Steinwold, managing partner at Sfermion, and John Egan, CEO at L’Atelier BNP Paribas, discuss NFTs and debate the characteristics of the metaverse. Show highlights:

- their backgrounds and how they got into NFTs

- how they each define the metaverse

- what NFTs have to do with the metaverse

- how John and Andrew’s depiction of the metaverse differs

- what John thinks about Facebook’s entrance into the metaverse

- whether Second Life is a metaverse game

- how blockchain technology allows for an open metaverse (and why Web2 is “communist”)

- what NFTs currently unlock for the metaverse

- whether the metaverse will necessarily have to be experienced through augmented reality

- whether there will be multiple metaverses across different blockchain platforms

- why John thinks NFT maxis and crypto maxis are destined to clash

- how the metaverse is changing how people generate income

- how to make the metaverse more accessible

- whether regulators will force the metaverse to be siloed

- how the metaverse will handle jurisdictional disputes

- what happens when someone’s Web3 avatar/identity is stolen in the metaverse

- what John and Andrew predict will happen in the metaverse over the next 6-12 months.

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians