And an interest in crypto

There was a flood of crypto headlines this week sparked by Tesla’s announcement Monday of a $1.5 billion dollar bitcoin position. Tesla’s announcement was followed by bitcoin’s price ripping through an $8k candle on its way to hitting another all time high at $48,200 before drifting back down to the mid-$40,000 range. This was not an altogether shocking purchase by Tesla as CEO Elon Musk has been very active on Crypto Twitter… As he tweeted:

While Tesla’s bitcoin purchase led to many stories, such as CNBC’s Jim Cramer advocating for bitcoin, and speculation regarding which institution(s) would be next, like the RBC Capital Markets research report pointing towards Apple as the next big company to move into bitcoin, the rest of the crypto world continued at a frenetic pace. For example, these announcements are on the cutting room floor of the news cycle: Bill Miller of the Miller Opportunity Trust plans to invest $300 million in bitcoin through the Grayscale BTC Trust, the Mayor of Miami, in an interview with Forbes, laid out plans for the city to become a progressively crypto-friendly, and Nigeria released a letter declaring the use of cryptographic assets to be illegal and Binance suspended deposits there. Crypto rarely fails to disappoint, but because of the Tesla investment, this week felt like a pivotal moment.

Listen to the Latest Episode of Unchained

Lyn Alden and Raoul Pal: Is Ethereum a Good Investment?

On this week’s episode of Unchained, Lyn Alden, CEO and founder of Lyn Alden Investment Strategies, and Raoul Pal, CEO & cofounder of Real Vision Group & Global Macro Investor, debate about whether ETH is a good investment, and talk about their perspectives on GameStop. This episode is getting a ton of reaction on Twitter and YouTube, so be sure not to miss it.

Listen to the Latest Episode of Unconfirmed

Michael Moro on Tesla’s BTC Buy and the New Genesis Treasury

On Unconfirmed this week, I spoke with Michael Moro, CEO of Genesis, about Tesla’s purchase of bitcoin, how and when Genesis began seeing interest from corporations pick up, and how it came to launch Genesis Treasury. Plus, he reveals what Genesis is expecting from the institutional world in 2021.

Thank you to our sponsors!

This Week’s Crypto News…

Big Banks and Credit Card Giants Continue Swiping Right on Crypto

Bank of New York Mellon, the nation’s oldest bank and a custodian of $41 trillion in assets, is making a move into crypto. According to the Wall Street Journal, the bank will hold, transfer, and issue bitcoin and other cryptos on behalf of its clients. “We are starting with the anchor in this space, which is custody,” Mike Demissie, head of advanced solutions at BNY Mellon, told CoinDesk. “Then it comes down to what our clients need from us. So that’s not just safekeeping of these assets, they want to leverage them for lending purposes, they want to leverage them for collateral. Then we are also looking at issuing digital assets, like tokenized securities, real assets.” BNY is the first large U.S.-based custodian to release a plan for storing crypto as it would any other asset. Although BNY declined to say which crypto-native companies it is using to build out its solution, it did confirm that the bank is relying on outside partners.

Mastercard announced it will offer its merchants the option to receive payments in select cryptocurrencies later this year. The company philosophy towards cryptocurrency is simple: “it’s about choice,” Mastercard Vice President for Blockchain and Digital Asset Products, Raj Dhamodharan, wrote in a blog post. Mastercard is not attempting to pressure consumers or businesses into using crypto, he said. Rather, they are here to “enable customers, merchants, and businesses to move digital value… however they want.” Dhamodharan later highlighted the four key items Mastercard is seeking in its crypto asset selection process: consumer protection, strict compliance protocols, adherence to local laws, and consumer demand. According to CoinDesk, Mastercard previously interacted with crypto through partnerships with Wirex and Uphold, but those programs were only for payments, not settlements. This will be the first time Mastercard will be accepting crypto payments without converting it to fiat for merchants.

As ETH Futures Launch, Analysts Say Ethereum’s Future Looks Bright

CME Group, the world’s largest derivatives marketplace, launched an ETH futures product on Monday. In an interview with The Block, Tim McCourt, CME’s managing director and global head of equity products, said ETH contracts were traded roughly 388 times to the tune of roughly 19,400 ETH, or $33 million. McCourt said, “The response to Ether has been overwhelming.” According to CME, each contract is made up of 50 ETH and priced in U.S. dollars, with the minimum trade size being five contracts. The enthusiasm about ETH futures spilled over into the price of ether, which roared past $1,800 on Tuesday, over triple its price when the CME futures were announced in mid-December. It was still trading around there as of press time.

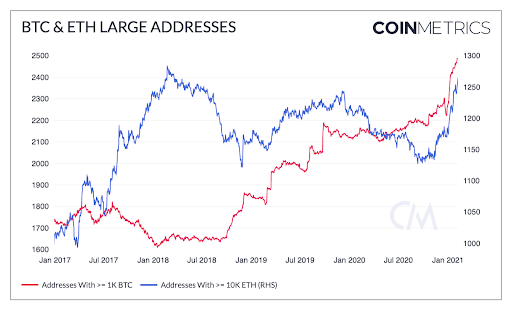

On-chain analysis and anecdotal evidence indicates institutional interest is picking up in ether. Coin Metrics reported on Monday that the number of Ethereum whale addresses is growing at a rate similar to that of Bitcoin whale addresses.

Also, Ethereum 2.0 reached a milestone indicating a bullish future: over 3 million ETH is now staked on the network.

Qiao Wang, co-founder of Messari Research, tweeted that “the earliest traditional financial institutions that bought BTC are already looking at ETH, if not bought already. And rightfully so. The most used crypto network + future of finance + a potential deflationary monetary policy narrative make it extremely compelling.” He projects the price of ETH will be between $5k-$20k by the end of this bull run.

Bitfinex Repays Tether Ahead of Schedule

Last Friday, crypto exchange (and sister company to Tether) Bitfinex announced that it had repaid a $550 million loan to Tether. In a statement on its website, Bitfinex said, “All interest due on the loan has been paid. The loan has now been repaid early and in full and the line of credit has been cancelled.”

According to The Block, “Tether [initially] opened a credit line worth $900 million for Bitfinex, of which $750 million was used by the exchange” because Bitfinex was in need of short-term cash in 2018. At that time, Bitfinex lost access to $850 million in customer and corporate funds when they were seized by a payment processor, Crypto Capital.

Bitfinex repaid two installments of $200 million on the loan in 2019 and 2020, leaving the balance at $550 million, which they paid off this week. This was the third and final installment of payments to close out the loan, which was due in November 2021.

The financial lifeline has been heavily scrutinized since April 2019 when the New York Attorney General’s Office alleged Bitfinex used Tether’s loan to secretly cover the exchange’s shortfall.

In other stablecoin news, Tether’s market cap recently crossed the $30 billion mark.

DeFi Roundup

- The St. Louis Fed released a DeFi research paper last Friday, which concluded that while DeFi is still “a niche market with certain risks… it also has interesting properties in terms of efficiency, transparency, accessibility, and composability.” The paper was written by Fabian Schar, a professor for distributed ledger technologies at the University of Basel.

- DeFi protocol Yearn utilized its treasury to pay back victims of the $11 million flash loan attack last week. According to the yearn.finance Twitter account, this act of kindness “was done as a one-off celebration of going through the DeFi rite of passage.”

- Europe’s largest telecommunications company by revenue, Deutsche Telekom, is now one of the main data providers to Chainlink, according to CoinDesk. Chainlink, a DeFi oracle service, provides smart contracts with data from the real world, which means Deutsche is providing active data support for DeFi.

MEV Is Becoming a Problem on Ethereum

A recent research report by Paradigm on Miner Extractable Value, aka MEV, highlighted the potential pitfalls that come with allowing miners to arbitrarily include, exclude, and reorder transactions within blocks they produce. Paradigm defines MEV as “the measure of profit a miner can make through their ability to arbitrarily include, exclude, or re-order transactions within the blocks they produce.” The report indicates that while most miners are not exploiting this feature now, within the last three months, Paradigm says, “a small but meaningful portion of the hashrate has been observed exploiting MEV themselves, revenue-sharing with traders rather than allowing permissionless fee auctions, and selling access to private memory pools.” Paradigm believes miners will pursue even more exotic forms of MEV, potentially even colluding, which could end up harming users and Ethereum, creating a sort of invisible tax on the protocol and encouraging consensus instability. Additionally, Paradigm says MEV can be seen on Bitcoin, though it is less of an issue there.

Crypto Quick Hits:

- Twitter’s CFO is considering adding BTC to the company’s balance sheet as well as paying employees and vendors in the digital currency

- Uber may accept payment in Bitcoin, but has no plans to purchase it as a reserve asset

- CoinDesk reports that Amazon is hiring for a new digital asset-based project in Mexico

- Treasury Secretary Janet Yellen spoke publicly on cryptocurrency for the third time saying “I see the promise of these new technologies, but I also see the reality: Cryptocurrencies have been used to launder the profits of online drug traffickers; they’ve been a tool to finance terrorism.”

- In the oddest news of the week, actress Lindsay Lohan sold a crypto collectible on Rarible for $17,000, which was flipped for $50,000 one hour later

German Police Stymied When Trying to Seize $81 Million in Bitcoin

Reuters recently reported that German prosecutors have confiscated from a bitcoin miner a stash of 1,700 bitcoin, worth about $81 million, as of press time. However, all they have is his hardware wallet. What they don’t have is the man’s password to unlock it.

The bitcoin miner was sentenced to two years in prison for installing bitcoin mining software on other people’s computers without asking permission, which is how he built his stack of 1,700 BTC. He already served his time and maintained his silence about the password throughout, while the police repeatedly tried to crack the code.

As Alex Gladstein of the Human Rights Foundation tweeted