PLUS: Is Thodex the next Quadriga?

This week was full of fun headlines, with two exchanges and two cryptocurrencies taking up the top spots in the recap. A former Coinbase executive, who recently served as the Acting Comptroller of Currency, will be joining Binance.US as its CEO. Coinbase also made headlines after reports came out documenting just how much stock its executive team sold last week. Bitcoin dipped over the weekend as a power outage in China reduced the hash rate protecting the network by 1/4th. Ether hit an all-time high on Thursday in anticipation of EIP 1559.

In other news, Dapper Labs doubled its valuation in just a few weeks while Digital Assets, CryptoSlam, and Aleo also announced fundraises. Galaxy Digital, who recently filed for a bitcoin ETF, is reportedly in talks to purchase crypto custodian BitGo, who, just last year, declined a $750 million acquisition offer from PayPal. Square and ARK Invest released a research memo on why Bitcoin mining could potentially promote renewable energy use. And, lastly, Dogecoin had an eventful week.

On Unchained, I was interviewed by the On Deck Podcaster Fellowship about the origins of the Unchained pod, how my background as a journalist prepared me for podcasting, and tips for aspiring creators. Be sure to check it out — I thought it was an enjoyable change of pace to be a guest on the show instead of the host. On Unconfirmed, Robbie Ferguson, co-founder and president of Immutable, discussed the launch of its new layer 2 solution, Immutable X, and how that could transform the world of blockchain-based games and NFTs.

Listen to the Latest Episode of Unchained

Thanks, Forbes: Laura on How the Unchained Podcast Came to Be

In a fun change of pace, I was interviewed by the On Deck Podcaster Fellowship about the origins of Unchained pod, how my background as a journalist prepared me for podcasting, and tips for aspiring creators.

Listen to the Latest Episode of Unconfirmed

Robbie Ferguson, co-founder and president of Immutable, talks about how Immutable is transforming the NFT industry through its layer 2 solution, Immutable X, which just launched April 8.

Thank you to our sponsors!

This Week’s Crypto News…

Binance.US to Hire Former OCC Chair as CEO

On May 1st, Brian Brooks will become the new CEO at Binance.US. Brooks recently stepped down as the acting head at the Office of the Comptroller of the Currency, where he served during the final nine months of the Trump administration. Before joining the OCC, Brooks was the chief legal officer at Coinbase, which is arguably the biggest competitor to Binance.US’s parent company Binance.

Under his leadership, the OCC released guidance allowing banks to custody crypto assets for customers and to use stablecoins to perform transactions. While his stint at the OCC was brief, spanning from last May to January of this year, during that time, he earned the nickname “Crypto Comptroller” on social media.

Binance.US is currently headed by Catherine Coley. Brooks confirmed to CoinDesk that she will depart by early May.

Meanwhile, at Binance, headed by CEO Changpeng Zhao, the exchange is facing scrutiny from UK regulators over its launch of digital stock tokens for Tesla and Coinbase. It appears the regulatory status around the tokens, which Binance says “represent a share in a stock corporation,” is a gray area since Binance does not clarify whether it is a security or derivative on its website. If deemed securities, the exchange would need to publish a formal investment prospectus.

Crypto lender BlockFi announced the addition of Christopher Giancarlo, the former chairman of the Commodity Futures Trading Commission, to its board of directors. Giancarlo was dubbed “Crypto Dad” for his support of crypto during his time at the CFTC.

Brooks and Giancarlo join Brett Redfearn, a top regulator at the SEC hired by Coinbase, and Max Baucus, a former senator brought on by Binance, in solidifying the trend of crypto companies bringing in U.S. regulatory veterans to help navigate U.S. regulations.

Coinbase CEO Sells Less Than 2% of His Shares

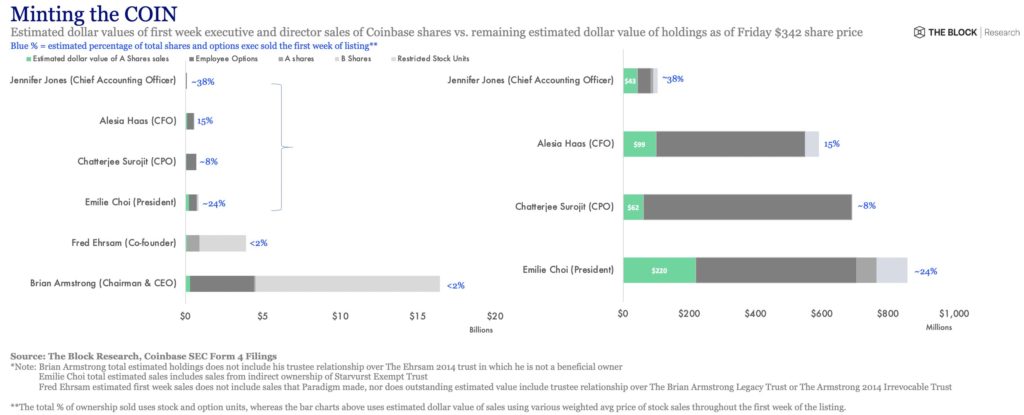

An incorrect yet semi-viral tweet made the rounds on Saturday suggesting that Coinbase chief executive officer Brian Armstrong sold 71% of his shares during Coinbase’s direct listing last week. The chart also mistakenly indicated chief financial officer Alesia Haas sold 100% of her shares.

However, The Block reported that Armstrong sold less than 2% of his holdings for roughly $290 million while Haas only sold 15% of her shares last week. Chief accounting officer Jennifer Jones led the executive team, selling 38% of her stock. While seeing high-level executives offload shares may have seemed scandalous or even disheartening to COIN owners, it should have been expected. A direct public listing almost forces insiders to sell because only the company’s existing shares are sold to the public. In the more standard initial public offering, new stock is issued to the public.

Bitcoin Hash Rate Drops and So Does Price

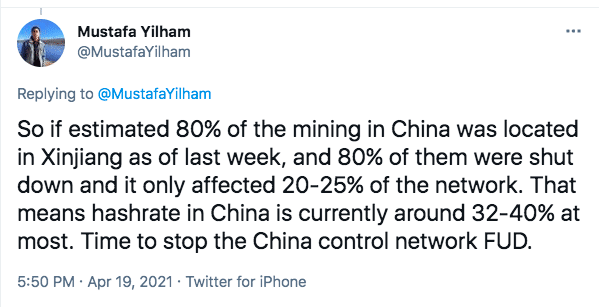

This past weekend, Bitcoin dipped from $60k to $53k in 12 hours. The dip coincided with a blackout caused by a coal mine explosion in China’s Xinjiang region, a significant player in Bitcoin mining. The Bitcoin hash rate, a measure of its computing power, dropped 25%.

Mustafa Yilham, vice president of global business development at Bitcoin miner Bixin, tweeted:

On-chain Bitcoin analyst Willy Woo wrote, “price and hash rate has always been correlated” and tweeted a chart showing the hour-by-hour plot of BTC price vs. hash rate moving downward in symmetric fashion over the weekend.

The Block reports that, as of Thursday, miners are gradually coming back online and real-time hash rate data already shows a 24-hour increase in computing power.

Ethereum Reaches New All-Time High

Ether broke through $2,600 for the first time on Thursday morning in a rally fueled by speculation that the upcoming adoption of Ethereum Improvement Proposal 1559, in which transaction fees will be burned, will result in a drop in supply.

Nick Spanos, co-founder of Zap Protocol, told CoinDesk that ether will “become a deflationary asset” which “will reduce the coin supply and have a corresponding effect on the price, creating an attraction point for buyers.” Ether is up 35% this month while Bitcoin is down 8%. The recent surge in ether coincides with Bitcoin market dominance shrinking to levels not seen since 2018, which was the last time Bitcoin market dominance slipped below 50%. On Thursday, Bitcoin’s market cap sat at $1.02 trillion or 48% dominance, while the entire crypto market was at $2.13 trillion, and ETH accounted for 14% of total market share.

Dapper Labs Headlines Another Big Week in Crypto Fundraising

- The company behind NBA Top Shot and CryptoKitties, Dapper Labs, is raising money at a valuation of $7.5 billion from Coatue Management. The latest raise will more than double its most recent round, which valued the NFT company at $2.6 billion in March.

- Digital Asset, an enterprise blockchain company, announced a $120 million Series D round to expand its team by 50% and build a protocol that can seamlessly interact across blockchains.

- Aleo, a platform specializing in zero-knowledge proofs allowing digital parties to interact without sharing underlying data, received $28 million from a16z, amongst others.

- Mark Cuban, billionaire investor and Shark Tank “shark,” announced an investment in CryptoSlam, an NFT data platform, at an undisclosed sum. (To hear about his NFT investment thesis, check out his recent appearance on Unchained.)

Losses May Reach $2 Billion at One of Turkey’s Largest Exchanges as CEO Flees

In echoes of the Quadriga CX fiasco, the Turkish crypto exchange Thodex said it does not have the strength to continue financially, according to Bloomberg. Losses at the exchange could be as high as $2 billion, and the 27-year-old CEO has fled the country. On Wednesday, Thodex halted all transactions. Before shutting down, it was trading more than $585 million in crypto daily and had around 400,000 users. CoinDesk reports that from an undisclosed location, CEO Faruk Fatih Ozer has come out in opposition to what he calls a “smear campaign” from customers and the public, explaining the transaction freeze was due to 30,000 user accounts being flagged as suspicious. Bloomberg reports that Ozer has promised to repay all investors and face justice upon his return to Turkey, that the government has blocked the company’s accounts, and that the police have raided its headquarters in Istanbul.

Galaxy Digital Is in Talks to Acquire BitGo

Mike Novogratz’s Galaxy Digital, a crypto investment firm, is reportedly in advanced discussions to purchase crypto custodian BitGo. A source familiar with the situation said to CoinDesk, “Galaxy does not do custody, so it makes sense to bring that in-house.” Last year, it was PayPal who had interest in BitGo. CoinDesk reports that the payments giant offered $750 million in cash for BitGo to no avail. PayPal later purchased Curv, a BitGo competitor.

Galaxy recently made headlines by filing for a bitcoin-ETF with the SEC last week.

Square and ARK Invest Believe Bitcoin Mining Promotes Green Energy

A research paper released by Square’s Bitcoin Clean Energy Initiative, with help from ARK Invest, lays out a vision for how bitcoin mining could accelerate the adoption of renewable energy sources.

It makes the case that Bitcoin miners are energy consumers with unique attributes: they can be turned on or off at any time and are completely location agnostic. Plus, they pay out in a liquid cryptocurrency. The paper calls Bitcoin miners “an energy buyer of last resort that can be turned on or off at a moment’s notice anywhere in the world.” It then provides statistics showing that unsubsidized solar and wind energy is now about 3-4 cents/kWh and 2-5 cents/kWh, respectively, while the average cost for fossil fuels such as coal or natural gas is 5-7 cents/kWh. The paper then describes a problem in renewable energy called “the duck curve,” in which energy demand is greatest in the late afternoon and early evening, while solar energy is most abundant during the day, and wind tends to blow more heavily at night.

While batteries will play a crucial role in storing renewable energy, the paper suggests that bitcoin miners are “an ideal complementary technology for renewables and storage.” Doing so would help more solar and wind projects become profitable, enable more solar and wind projects in places not as well-connected to the grid, and provide the grid readily available excess energy for especially hot or cold, and, therefore, energy-intensive days. Additionally, they add, it would spur “a sizable transformation and greening of the bitcoin mining industry.”

5 Headlines to Break Down Dogecoin’s Crazy Week

- The Dogecoin community selected April 20th, aka 4/20, as “dogeday,” with plans to send the memetic coin to the moon, or, at the very least, to 69 cents per coin.

- Dogecoin’s market cap reached $54 billion this week, more than doubling Ethereum’s market cap just one year prior.

- According to The Block, institutional investors are getting in on the Dogecoin price action, with some market makers and OTC desks handling million-dollar trades in DOGE.

- A person using the moniker “Doge community” reportedly donated profits from her successful Dogecoin investment to a dog shelter in Florida, paying for all the donation fees of dogs ready to be adopted.

- Joe Weisenthal, executive editor at Bloomberg, wrote, in I believe all seriousness, “Dogecoin’s so-called ‘monetary policy’ may be better than Bitcoin’s.”

Fun headlines aside, Dogecoin failed to live up to its own moon-high expectations for April 20th, with the coin actually dropping ~20% over the 24-hour period.

I thought Qiao Wang, former co-founder of Messari, summed up the crazy week in Dogecoin best:

Disclosure — I honestly think Dogecoin’s price action was just shy of a pump and dump and I feel bad for the many people who undoubtedly lost money on it. However, the price action, community, and industry interest led to its inclusion in Fun Bits.