October 25, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Reddit is planning to build an NFT platform, according to a recent job posting.

-

Over $2 billion in Ethereum has been burned by EIP 1559.

-

Two banks signed up for bitcoin trading platforms through Q2 and NYDIG.

-

The Robinhood crypto wallet waitlist is well over a million people long.

-

A pension fund for Houston firefighters invested $25 million in crypto.

-

Nigeria is set to launch its digital currency.

-

Terraform Labs CEO Do Kwon is suing the SEC (after being served with a subpoena).

-

Thorchain is back online.

-

Elon Musk tweeted about Dogecoin, and Dogecoin pumped.

-

A Binance Smart Chain proposal would adopt Ethereum’s burn mechanism.

-

Coinbase spent almost $800,000 on lobbying in Q3.

-

The CFTC is conducting a probe into Polymarket, a decentralized prediction protocol.

What Do You Meme?

What’s Poppin’?

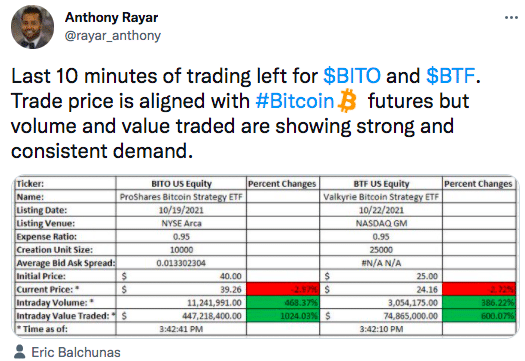

Valkyrie Investments’ launched its bitcoin futures exchange-traded fund (ETF) on Friday, becoming the second such product to list with the approval of the Securities and Exchange Commission.

Valkyrie’s Bitcoin Strategy ETF’s first day saw about $78 million in volume for the fund trading under the ticker $BTF on the Nasdaq.

(Editors Note: Valkyrie initially filed under the ticker BTFD… and anyone who spends hours on Crypto Twitter will know means “buy the f***ing dip.” However, the company ended up changing the ticker to BTF.)

Bloomberg’s Anthony Rayar described the volume and value for $BTF and $BITO (ProShares’ bitcoin futures ETF that launched last week with nearly 12X the volume as $BTF) as showing “strong and consistent demand.”

Recommended Reads

- CoinDesk on whether “code is law” will stand up in court:

- Nansen on the rise of CryptoPunks (written by a 17-year-old analyst):

- Arcane Research on the Lightning Network ecosystem:

On The Pod…

Bitcoin Projected to Reach $135,000 in December, According to PlanB

PlanB, a former institutional investor with 25 years of experience in financial markets turned anon Bitcoin analyst, discusses Bitcoin’s price action, from the macroeconomic drivers to what his models predict for the rest of 2021. Show highlights:

-

PlanB’s background and how he got into Bitcoin

-

what a stock-to-flow model is and how PlanB uses it to predict Bitcoin’s price

-

why PlanB called for a $1 trillion market cap when Bitcoin was priced at sub $4K

-

how the approval of a bitcoin futures ETF has affected Bitcoin’s price

-

why institutions are more comfortable with bitcoin futures, rather than the underlying asset

-

how to properly calculate gold’s stock-to-flow model

-

why he believes the stock-to-flow models works — even when detractors say it is flawed

-

how the pandemic has affected Bitcoin’s price

-

what PlanB thinks about China’s decision to effectively ban Bitcoin

-

the three charts PlanB uses to model Bitcoin

-

what the price floor for Bitcoin will be in October, November, and December

-

whether PlanB thinks we are in a supercycle

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians