A record week

Happy New Year! The crypto market has started 2021 off with a bang, with its total market cap crossing $1 trillion. Bitcoin continues to rocket to new all-time highs, hitting $40k, while Ethereum is also on the move, reaching prices not seen since January of 2018. And popular crypto exchange Coinbase is feeling the burden of record amounts of web traffic.

In other news, the OCC says that banks are free to use stablecoins for payments and other activities, a huge step forward for digital currencies in the mainstream financial world. Ripple investors and XRP whales continue to react to news of the SEC’s lawsuit against Ripple. And Coinbase has said they would join a16z in court to challenge the SEC’s proposed crypto wallet rules, should they become law.

Also, Vitalik published a guide to rollups on Ethereum that is a must-read for anyone curious about scalability. And ShapeShift is going DeFi, leaving behind know-your-customer regulations.

On Unchained, we have a panel on central bank digital currencies, and on Unconfirmed, Frank Chaparro of the Block and I discuss what we think will be the big crypto stories in 2021, and his predictions for the year. And in case you missed it last week, we covered the highlights of 2020 on Unchained, and I gave part 2 of my holiday AMA.

This Week’s Crypto News…

Total Crypto Market Cap Reaches $1 Trillion for the First Time

With little hype compared to 2017, the total market capitalization of cryptocurrencies reached $1 trillion for the first time on Wednesday, with Bitcoin soaring to $37,000 three hours after surpassing a new all-time high of $36,000. As of press time, the price breached $40,000 for the first time, a huge milestone for the 12-year-old cryptocurrency. JP Morgan analysts speculate that Bitcoin’s price could reach $146,000 over the long term, with their strategists saying that the king of crypto is competing with gold for investment flows. Meanwhile, number two crypto Ethereum has surpassed $1,200, a price level not seen since the last bubble at the beginning of 2018.

Amid these high-flying prices, The Block reports that cryptocurrency exchanges are seeing high levels of traffic, with total visits in December alone reached 196 million, up from 79 million a year prior. Coinbase, which will be going public later this year, struggled with connectivity issues for six hours on Wednesday before finally resolving the issue.

OCC Says Banks Can Use Stablecoins

The Office of the Comptroller of the Currency published an interpretive letter on Monday saying federally regulated banks may use stablecoins for payments and other activities. They can also participate in blockchain networks. Kristin Smith, executive director of the Blockchain Association, tweeted, “the letter states that blockchains have the same status as other global financial networks, such as SWIFT, ACH and FedWire.”

Ripple and XRP Roundup

The fallout continues for Ripple after the SEC announced it was filing charges against the company and two executives last month. Tetragon, the lead investor of Ripple’s $200 million Series C funding, has filed suit against the company in light of the SEC’s charges. The complaint seeks to “enforce its contractual right to require Ripple to redeem” its Series C preferred stock — or in plain English, give its money back. Tetragon is also attempting to freeze Ripple from using any liquid assets until this payment is made.

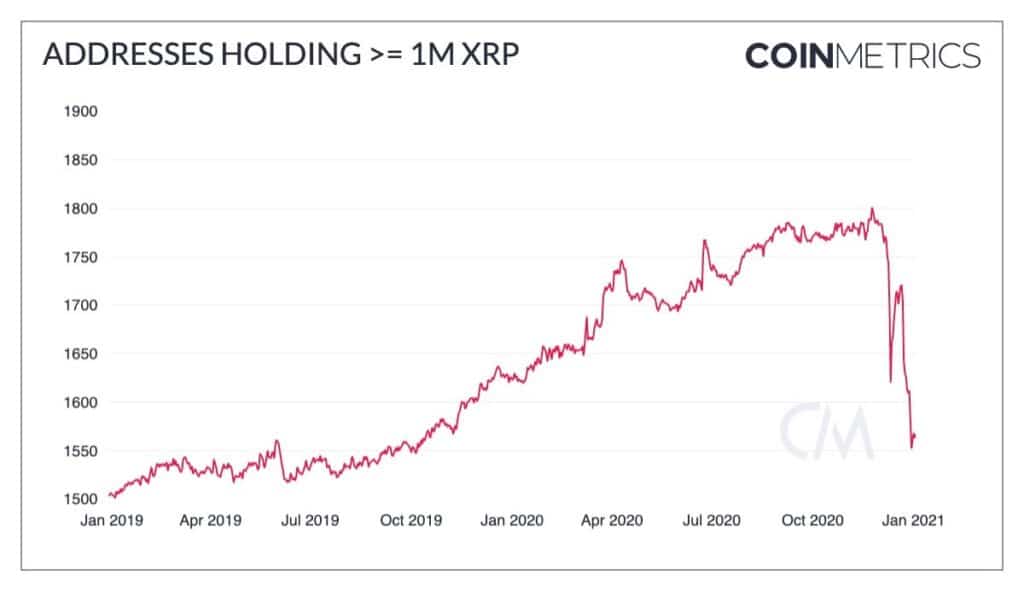

Since the SEC announced the lawsuit, the number of XRP whale addresses has fallen more than 8% as many prominent crypto exchanges have delisted or suspended XRP trading.

Firms to have announced delistings and trading suspensions include Coinbase, Crypto.com [disclosure: a sponsor of my shows], Genesis, Blockchain.com and Binance US. Grayscale has also removed XRP from its Large Cap Crypto Fund and halted new subscriptions to the Grayscale XRP Trust. Bitwise has also liquidated its position in XRP from its Bitwise 10 Crypto Index Fund.

Coinbase and a16z Prepare Challenge to Proposed Crypto Wallet Rules

Top crypto exchange Coinbase and venture capital firm Andreessen Horowitz are planning to challenge in court the Financial Crimes Enforcement Network’s proposed crypto wallet rules should they become law. Coinbase CEO Brian Armstrong and a16z’s Kathryn Haun announced their intentions in dual tweets on Monday. Haun, a former federal prosecutor, said the proposed rules by FinCEN to subject all crypto wallets, including those that are self-hosted, to know-your-customer and reporting requirements would have “many foreseeable and unintended negative consequences.”

The rule is also being criticized for because of the rushed process by which it is being considered. As Jerry Brito of Coin Center tweeted out, the original official deadline given was January 4. However, on that day, the deadline was extended to January 7, with a quiet change on the website. As he tweeted, “Commenters raced to honor the Jan 4 deadline and were never notified of a change before the end of that day. As a result they were effectively afforded not the promised 15 days but only 12.” He added, “Serious commenters … could have used the 3 extra days.” This lends more fuel to the contention that the process violates the Administrative Procedures Act.

Vitalik Breaks Down Rollups

Scalability has been the big issue facing Ethereum — well, ever since inception — but even more urgently, since 2017. This week, creator Vitalik Buterin published a post explaining the differences between the three major types of layer-2 scaling currently available: channels, Plasma, and rollups, but does a deep dive on rollups to explain why they “are poised to be the key scalability solution for Ethereum for the foreseeable future.” There is a detailed explanation of the two different types of rollups — Optimistic rollups and ZK rollups — including a chart laying out the tradeoffs between the two and how much scaling you can expect to receive with rollups. Vitalik’s take is, “in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.”

ShapeShift Goes Full DeFi

ShapeShift CEO Erik Voorhees announced on Wednesday that the trading platform “has integrated decentralized exchange protocols and is sunsetting its 6+ year business of trading with customers.” The change means that ShapeShift users will no longer be required to provide personal identifying information to use its services. Instead, it has integrated with dexes including Uniswap, Balancer, Curve, Bancor, Kyber, 0x and half a dozen other dexes. Voorhees says this will allow Shapeshift access to more jurisdictions, since the company will no longer be an intermediary.

The Block’s 2020 Year in Review

The Block published its yearly review, highlighting what it calls “ten developments that solidified the future of cryptocurrencies in 2020.” The recap starts with, of course, the biggest story of the year — Bitcoin — noting its total market value crossed $500 billion. The emergence of stablecoins as critical infrastructure and the rise of DeFi are also covered, retail and merchant access through Square and PayPal, and more. It’s a good, comprehensive look at the major trends of last year, and ends on regulation, which I think we’ll see is a big driver of news this year.

XRP Army Storms SEC

Leave it to Crypto Twitter to make a mashup of big news from the crypto world — the SEC’s lawsuit against Ripple — and the real world, in this case, the mob that stormed Capitol Hill on Wednesday.

Smol ting tweeted — of course in all caps — “BREAKING NEWS: $XRP ARMY HAS STORMED SEC HEADQUARTERS”