And Binance begins to block US customers

This week, the Ethereum community was rattled by a surprise chain-split that some called an unannounced hard fork, leading to demands for increased transparency from Ethereum devs.

The other big news this week: Bitcoin surpassed $16k for the first time in three years. Meanwhile, big-name investors are sending dueling signals about it, with billionaire Stanley Druckenmiller revealing that he owns Bitcoin and Ray Dalio of Bridgewater Associates saying he believes governments will ban the digital currency if it continues to grow.

We’ve also got news on Biden’s first announcements of who will be steering his financial policy, a pointed critique from Congress addressed to the OCC’s Brian Brooks, a roundup of news surrounding exchanges in Asia, and more.

On the podcasts, Dan Tapiero and Cathie Wood discuss Bitcoin under a Biden administration on Unchained. And on Unconfirmed, Chad Cascarilla of Paxos, talks about how Paxos is helping PayPal enable crypto purchases for all its US customers.

This Week’s Crypto News…

Ethereum Chain Accidentally Splits in 2

On Wednesday, what seemed to be a significant issue with Ethereum infrastructure provider Infura turned out to be the result of a bug in the Ethereum code that split the network’s transaction history in two. The turmoil began when a major service outage struck Infura around 8:00 coordinated universal time, prompting some exchanges, including Binance, to halt ETH and ERC-20 token withdrawals temporarily.

It turns out, the bug was actually intentionally triggered. Optimism cofounder and CEO Jinglan Wang tweeted an apology Wednesday evening, explaining that the Optimism team had noticed the bug but, after seeing that almost all nodes had upgraded to the fix, they “decided to test the bug and see what would happen. This was boneheaded in hindsight,” she wrote.

The outage’s actual cause was a bug in the Go Ethereum client, which is used by 80% of Ethereum applications. A chain split appears to have been triggered by the consensus bug Ethereum developers had quietly patched a year ago in the Geth v1.9.7 release. Geth team lead Peter Szilagyi posted in a blog that the team didn’t warn people that this fixed a consensus bug because, “In the case of Ethereum, it takes a lot of time (weeks, months) to get node operators to update even to a scheduled hard fork. Highlighting that a release contains important consensus or DoS fixes always runs the risk of someone trying to beat updaters to the punch line and taking the network down.” Others called for increased transparency from Ethereum devs. Nikita Zhavoronkov, lead developer at Blockchair, argued that the event constituted a consensus failure that could be “the most serious issue Ethereum has faced since the DAO debacle 4 years ago.”

Infura and other service providers affected by the chain split have since fixed the issue by updating their nodes, with Infura posting a post-mortem on its blog. The price of ETH itself was not affected at all by the snafu.

Bitcoin Price Roundup

- For the first time in three years, Bitcoin surpassed $16,000 after a week of consolidating between $14k-$16k. Bitcoin is now up 123% this year.

- Billionaire hedge fund investor Stanley Druckenmiller revealed that Bitcoin is a part of his portfolio. Anticipating a three- to four-year decline in the dollar, Druckenmiller said, “Frankly, if the gold bet works, the bitcoin bet will probably work better because it’s thinner, more illiquid and has a lot more beta to it.”

- Bridgewater Associates founder and co-chairman Ray Dalio said this week that should Bitcoin become “material,” he could foresee a time when governments would move to outlaw it. I have a feeling that if that were to happen, PayPal, Fidelity, Square and other big companies would probably have something to say about that.

- Bloomberg’s senior commodity strategist Mike McGlone says Bitcoin may break $20,000 in 2021, adding to his previous projection that Bitcoin could then experience a parabolic year. If you didn’t catch my interview with Mike McGlone on Unconfirmed in May, check it out here.

Crypto Community Optimistic About Gary Gensler Leading Biden’s Financial Policy Transition Team

President-elect Joe Biden has tapped former Commodity Futures Trading Commission chairman Gary Gensler to lead his financial policy transition team and advise on Wall Street oversight during his administration. Gensler is well-versed in cryptocurrency and has testified before Congress on multiple occasions regarding cryptocurrency and blockchain technology. He staunchly opposed the notion that cryptocurrencies were nothing more than Ponzi schemes and has referred to blockchain technology as a “change catalyst.” Putting Gensler in this role suggests that Biden’s win will be “a good thing” for cryptocurrency, as Kristin Smith of the Blockchain Association told Fortune.

U.S. Lawmakers Criticize the OCC’s Focus on Cryptocurrencies

In what appears to be the first substantial Congressional critique of a financial regulator who favors cryptocurrency, six Congress members issued a letter Tuesday faulting acting OCC chief Brian Brooks for prioritizing crypto during the ongoing health and economic crises brought on by COVID-19. The letter stated that Brooks should have no business bolstering crypto banking when millions of Americans need economic relief and said such actions could put “the entire hierarchy” of dollar-denominated financial assets at risk.

In a blog post, Union Square Ventures’ Fred Wilson, wrote, “If the United States was developing (as is China), a digital currency stablecoin (a digital dollar), then those millions of at-risk individuals would have been able to receive their economic stimulus funds via any one of the popular mobile apps that support or will soon support digital assets, like Coinbase, Square, PayPal, Robinhood, and many more.

“It would have been less expensive (by an order of magnitude or more) and much simpler to get funds to these at-risk individuals with blockchain based assets vs outdated technologies like paper checks.”

Asian Exchange Roundup

- On the heels of two legal cases launched by the U.S. government against crypto derivatives exchange BitMEX, Binance has begun blocking U.S. users from its platform, directing them to withdraw funds within 90 days if based in the U.S.

- In a tweet Wednesday, KuCoin co-founder Johnny Lyu said that the exchange had recovered 84% of affected assets from the $280 million hack in September, adding that further recovery details can’t be revealed until the case is closed by law enforcement agencies.

- A month after OKEx suspended on-chain crypto withdrawals, users have devised different ways to remove their crypto assets, often at a discount of at least 20%, using OKEx’s over-the-counter platform, internal transfers, and other, riskier methods. During that same time, OKEx’s Bitcoin mining pool has lost nearly all of its hash rate power, with data showing the pool has fallen from producing close to 9,000 petahashes per second to only 20 PH/s now.

Bitcoin More Equitably Distributed Than Other Cryptos

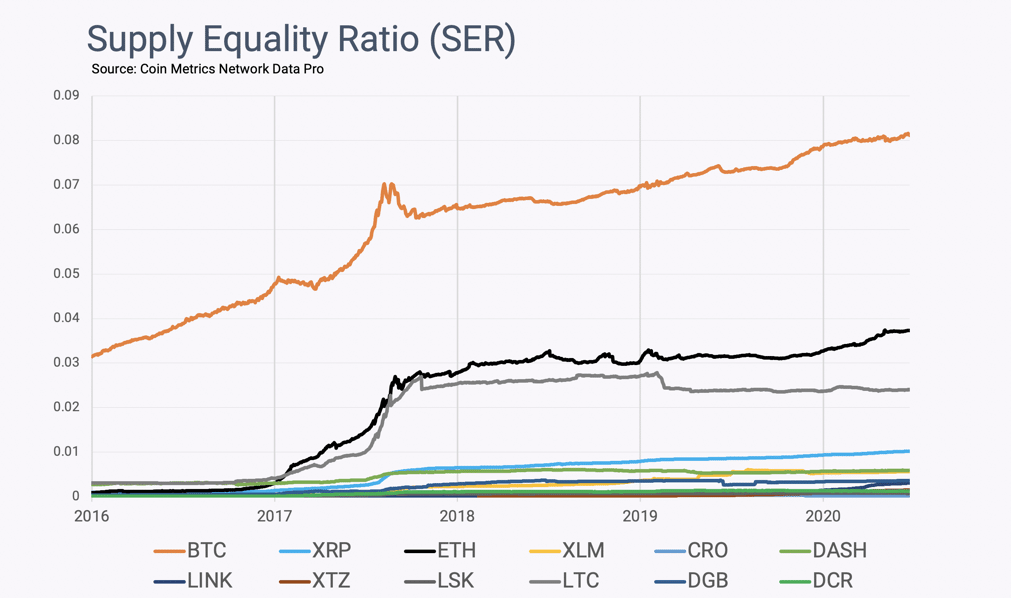

According to Coin Metrics, even as Bitcoin continues to be the primary crypto asset custodied by large financial institutions, Bitcoin looks more like a grassroots movement in terms of wealth inequality. The first inequality metric, Supply Equality Ratio, is the ratio of the poorest accounts, the sum held by all accounts with a balance less than 0.00001% of the supply, against the richest accounts, which is the total held by all the top 1% of addresses. Compared to other crypto assets, Bitcoin’s Supply Equality Ratio is much higher, at 0.08, compared to below 0.04 for Ethereum.

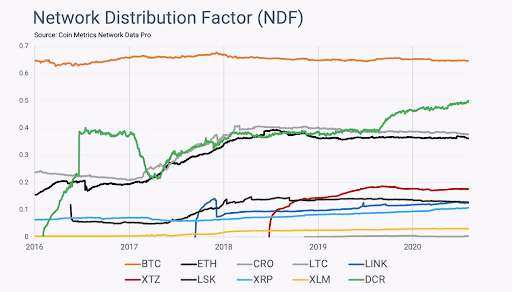

Coin Metrics also looked at the supply dispersion through a metric called the Network Distribution Factor, a ratio encompassing a broader economic group more equivalent to middle and lower classes, which is calculated by taking the aggregate supply in addresses holding more than 0.01% of a cryptoasset’s supply and dividing that by the total supply. Bitcoin continues to have the highest distribution factor — greater than 0.6, compared to 0.5 for Decred.

Everything You Wanted to Know About Oracles

It’s commonly known in the crypto community that oracles are a tricky thing to use and implement well. But this post by Sam Czsun, a security researcher now at Paradigm, goes into all the ways price oracles can be manipulated. He starts with a real-life example of someone who wanted to go backstage at a concert to meet the band and so updated its Wikipedia page to say he was a family member right before he approached the security guards. Then Sam walks through several examples of how price oracles have malfunctioned or been manipulated, starting with the time a broken Korean Won price oracle on Synthetix enabled a trading bot to make off with $1 billion — which I’ve discussed with Kain Warwick of Synthetix. Other examples he gives are people manipulating prices on Uniswap, where prices are constantly fluctuating. He says, “trying to read that price accurately is like reading the weight on a scale before it’s finished settling.” There are numerous examples here, so if you want to have a greater understanding of how your DeFi trades could go wrong, this would be a great post to check out.

Ethereum 2.0 Community Staking Grants

Are you interested in building up the Eth2 staking and validator community? If so, The Ethereum Foundation is sponsoring a wave of Eth2 staking community grants, “funding the creation of tools, documentation, and resources to make for a delightful staking and validator experience.” Anyone is free to participate, and proposals are due by December 22, 2020.