September 15, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- A bankruptcy judge approved an order to appoint a neutral third party to examine the finances of Celsius.

- SEC Chair Gary Gensler wants SEC staff to “recommend a pathway” for crypto tokens to register as securities.

- Sam Bankman-Fried’s FTX is raising capital to fund acquisitions, according to CoinDesk.

- Coinbase added a feature for US users to see the crypto sentiment scores of congress members.

- The Ethereum Classic hash rate shot up by 280% in one day.

- The US Treasury sanctioned BTC addresses allegedly linked to Iranian ransomware attacks.

- Ethermine, the world’s largest Ethereum mining pool, will stop offering proof-of-work services after the Merge.

- Maker, the DeFi protocol behind the DAI stablecoin, announced that it has doubled its debt ceiling on its staked Ethereum (stETH) vault to reduce USDC exposure.

- The Securities and Exchange Commission filed a suit against a Chicago-based crypto merchant for unregistered securities offering.

Today in Crypto Adoption…

- BNB chain partnered with Google Cloud to boost growth of Web3 and blockchain startups.

- The Museum of Modern Art of New York might sell $70 million worth of art to expand the museum’s digital footprint.

The $$$ Corner…

- Venture capital firm Two Sigma Ventures raised $400 million across two funds.

- Diamond tokenization startup Diamond Standard closed a $30 million series A funding round.

- JPMorgan invested in blockchain infrastructure developer Ownera’s $20 million round.

What Do You Meme?

What’s Poppin’?

Ethereum Executes Historic Merge

Today morning, Ethereum transitioned from proof of work to proof of stake.

It is a historic moment for the cryptocurrency industry. Ethereum is the second largest blockchain, second to Bitcoin, and by far the largest smart contracts platform in the world.

After long years of research and delays, the Merge was activated at 6:44 am UTC today. Yesterday, the forecasts were saying that the estimated time would be around 5:00 am. But as the hash rate of the PoW chain was declining, it took longer to reach the Total Terminal Difficulty (TTD) that would trigger the upgrade.

The upgrade was considered finalized after the first epoch, which was approximately 15 minutes after the activation. “And we finalized! Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today,” said Vitalik Buterin, founder of Ethereum.

The Merge puts an end to the network’s crypto mining, which is an energy-intensive process, and as a consequence energy consumption reduces by 99.98%. This will make Ethereum Environmental, Social, and Governance (ESG) compliant, an important factor for many investors and regulators.

According to Justin Drake, researcher at the Ethereum Foundation, the Merge will reduce worldwide electricity consumption by 0.2%. By the way, do you have any questions for Justin? Let us know!Even though the technical challenge to do this change in the consensus mechanism was huge, the Ethereum team has pulled it off and it seems that things are running smoothly.

The Merge implemented some features to allow ETH to become better money by changing its monetary policy. In the first three hours, the supply of ether has decreased by ~177 ETH ($283,000 at current prices). This happens because there is more ether being burned than being issued, which makes the asset deflationary and become what has been called “ultra sound money”.

Following the activation of the Merge, someone paid 36 ETH (more than $50,000) to mint the first NFT in the PoS chain. The NFT shows a panda, the symbol of the Merge.

Within hours of the upgrade, a validator has already been slashed for making multiple double attestations, which are the way validators check transactions.

The price of ether is trading relatively flat, meaning that the Merge news didn’t have much of an impact in the markets. ETH moved by less than 1% after the first minutes of the upgrade, and is trading at around $1,600. One thing that did change was the futures market, and the backwardation (when the futures price is less than the spot price) has reversed.

“If this happened last year we’d be at $8,000 already,” March Zheng, a Shanghai-based partner at Bizantine Capital told CoinDesk. “But the fundamentals couldn’t be stronger.”

Recommended Reads

- Mesky on the Merge

- Haym on Ethereum’s roadmap

- Bloomberg’s article on the Ethereum Merge

On The Pod…

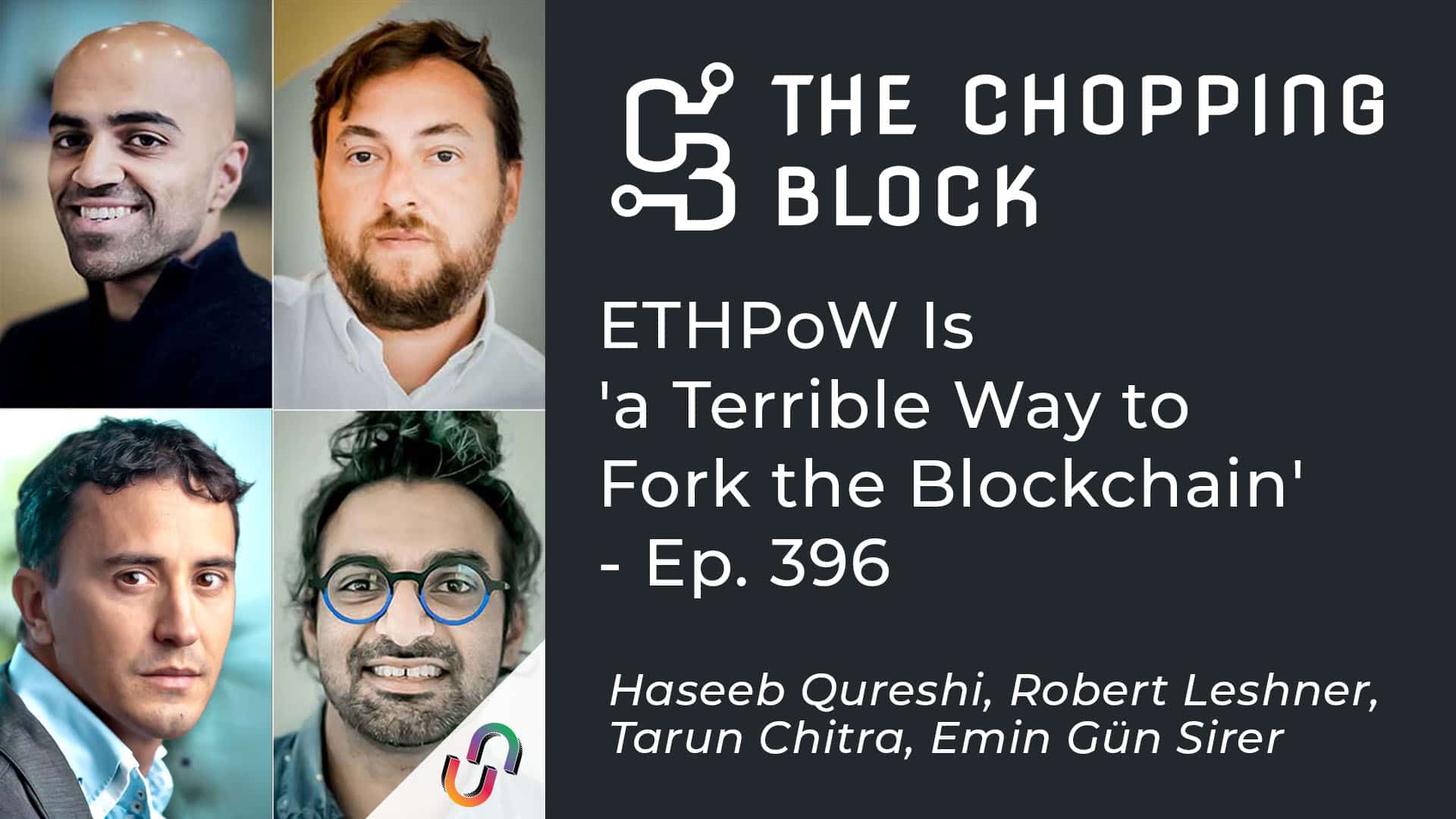

Welcome to The Chopping Block! Crypto insiders Haseeb Qureshi, Robert Leshner and Tarun Chitra chop it up about the latest news in the digital asset industry. In this episode, Emin Gün Sirer, the emperor of Avalanche, also joined the conversation. Show topics:

- Gün’s take on the Ava Labs conspiracy story and whether there was any truth in the videos

- The impact of the Merge on ETH issuance and energy usage

- What’s going on with the ETHPoW fork, and how the team has been messing up

- The TL;DR of the technical side of Ethereum scaling, explained by Tarun

- What Ethereum miners are going to do after the Merge

- Whether Coinbase’s support of the lawsuit against the US Treasury over Tornado Cash was a PR move

- How this moment in history resembles the ‘90s and the rise of the internet

- How FTX and Coinbase have different approaches to regulation

- How would everyone celebrate a successful Merge and whether there’s a chance of it failing

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians