Runes, a new token standard for fungible tokens on Bitcoin, has seen a substantial decline in fees since it first launched one month ago, on April 20. The decline may call into question the standard’s staying power.

“Right now you’re seeing ‘lumpiness,’ where you have a new project come out [such as Runes], and] you have transaction fees that are high for a period of time. Ideally, over time, that kind of levels out. Rather than these big blips of transaction fees, you’ll be seeing more of a levelized balance,” Asher Genoot, CEO of Bitcoin mining firm Hut 8, told Unchained.

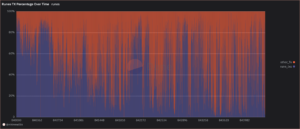

According to a Dune dashboard created by Matt Kimmell, an analyst at digital asset investing firm Coinshares, Runes dominated total transactions and fees generated on Bitcoin’s blockchain network when it first launched. This followed substantial hype from the broader crypto community, which viewed Runes as a superior alternative to the BRC-20 standard for fungible Bitcoin-native tokens, because of Runes’ smaller onchain footprint.

Genoot has been tracking experiments like Runes and BRC-20 tokens on the Bitcoin network, because they make “a pretty big impact on the rewards and hashprice overall that [Hut 8 is] able to generate.”

Read More: What Are Runes? A Guide to the New Fungible Token Protocol on Bitcoin

For the blocks immediately after height number 840,000, when the halving was activated, Runes was responsible for over 90% of all transactions and fees on Bitcoin. While Runes at times still make up a large majority of transactions, overall Runes activity has slid as a share of Bitcoin activity. Runes made up less than 3.5% of all transactions in blocks 844,336 and 844,337, for example.

Bitcoin’s current block height number is 844,354, per Bitcoin explorer Mempool.space.

Runes Fees

“When you launch some of these new platforms [or standards such as Runes], there’s market demand, there’s hype that drives it, etc., and you see a lot of the appetite that drives those transaction fees and drives that premium [initally],” Hut 8’s Genoot said.

However, the market demand for Runes has since tapered off. Runes fees as a percentage of all fees in a block saw an even steeper decline than the volume of Runes transactions. For blocks 844,336 and 844,337, Runes made up less than 2% of total fees.

Runes still make up the majority of the fees for some blocks, such as block 843,859, when Runes was responsible for 86.1% of all fees. But Colin Harper, Luxor’s head of content and research, characterized the overall decline as Runes fees having “plummeted this month” in a message to Unchained.

Genoot thinks it’s too soon to tell whether this decline means that Runes or any of the new Bitcoin experiments are a fad, or if a use case might grow over time.

“I love that new technology is coming out,” Genoot said. “I think time will tell which technologies gain traction and which don’t.”

The Decrease in Runes Fees Coincides With a Drop in Bitcoin’s Mean Transaction Fee

The decrease in Runes activity comes one month after the protocol’s rollout, which coincided with Bitcoin’s fourth halving. The halving decreased block rewards to miners from 6.25 BTC per block to 3.125 BTC.

Runes is cooling off at the same time that average transaction fees on Bitcoin have substantially declined. At the time of the halving, the average transaction fee on Bitcoin stood at 0.00199 BTC, or about $130, But at press time, the figure has dropped to 0.000025, or about $1.68, a nearly 99% decrease, according to Glassnode data.

The price of BTC has increased from around $64,308 at the time of the halving to $69,816 at presstime, representing an 8.5% jump, data from CoinGecko shows.