A $237 million program to catalyze gaming is coming to the Arbitrum ecosystem—or is it?

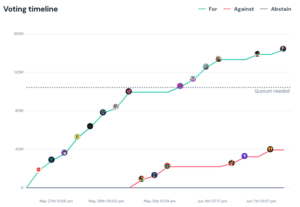

Community members of the layer 2 blockchain network passed an onchain proposal on Friday that authorizes the allocation of 225 million ARB tokens intended to expand adoption of Arbitrum by builders and players in the gaming industry. However, some want a repeal or a revote.

Even though the gaming proposal had majority support in both its temperature check in March and onchain vote on Friday, the proposal drew substantial opposition. In the end, 23.7% were against the gaming allocation.

Voting against the initiative, Bitcoin OG and co-founder of NFT project Taproot Wizards, Eric Wall said on the onchain proposal that the 225 million ARB allocation “is simply too much of a budget.” Similar gaming ecosystem funds for competitor chains are a fraction of the size.

ARB Market Dilution

GFX Labs, the team behind Oku, a front end interface for Uniswap, voted against the gaming proposal on Arbitrum. In the forum discussion, GFXLabs shared several concerns about the initiative such as how the influx of 225 million tokens may impact the market.

In the past year, Arbitrum’s native token has underperformed, sliding 4.3% In contrast in the same time period, Ethereum’s ETH has jumped 105% to $3,780, and Optimism’ OP has increased 83% to $2.51, per CoinGecko.

Read More: Should Ethereum Layer 2s Urgently Decentralize Their Sequencers?

Despite having strong fundamentals, Arbitrum’s lagging price performance “is a reflection on the constant dilution that Arbitrum’s spendthrift programs have inflicted upon the token,” GFX Labs said in comments dissenting on the proposal. “Arbitrum has a spending problem, and putting 8% of the chain’s entire TVL into a highly speculative venture is bad financial stewardship.”

“225,000,000 new ARB issuance is very dilutive and will affect your bags. Dilution isn’t evil, but it needs to be thoughtful, efficient, and compared to alternative uses of the funds,” GFX Labs added.

Lack of Clarity

Risk management firm Karpatkey, while interested in growing Arbitrum’s gaming ecosystem, also voted against the proposal citing several reasons, namely the lack of “clarity on the legal structure to be used for these investments,” the considerable operational expenses, and how the “funds’ management appears to be delegated to the Arbitrum Foundation with no ringfencing or assets,” among others.

Karpetkey also said, “This proposal represents a large disbursement for the Arbitrum DAO to be added to the already high annual spending impacting the Treasury.”

Read More: Elixir Capital Submits Governance Proposal to Establish $50 Million Arbitrum Startup Collective

Voters Who Flip-Flopped

A number of voters had initially supported the seven-figure gaming allocation earlier in the governance cycle to only switch at the last stage. Some reversed course because the proposal originally sought 200 million ARB from the DAO’s treasury, but after edits, the total earmarked increased to 225 million tokens.

In light of the increased operational expenses, Michigan Blockchain, a student organization based at the University of Michigan, changed its vote, citing the rationale by GFX Labs.

GFX Labs argued that the increase is not a small amount “It’s a mistake and against the spirit of open governance to simply add in a discretionary $25m,” wrote GFX Labs, calling it “a very bad look” that has “raised alarm bells amongst some investors and community members.”

Camelot, a decentralized exchange native to Arbitrum with a total value locked of over $112 million, followed Michigan Blockchain in supporting the proposal during the Snapshot but then opposing it onchain.

In its opposition, Camelot highlighted the increased compensation package of 25 million ARB tokens, while also naming the lack of clarity regarding the legal structures and “how the DAO is going to effectively manage assets from companies in which it invests.”

Read More: Why Ethereum’s Vitalik Buterin is Unhappy With This Cycle’s Celebrity Experimentation

Who Supported Arbitrum’s Gaming Catalyst Program

At the close of voting Friday, with officially approved earmarked funds to target the gaming vertical, Arbitrum joins other blockchain networks vying to attract gaming builders with capital.

For example, Starknet Foundation, the nonprofit supporting the layer 2 network Starknet, announced in March 2024 the formation of its Gaming Committee, which has a 50 million STRK budget worth $66 million to fund proposals. Also in March, Immutable, King River Capital, and Polygon Labs formed their $100 million Inevitable Games Fund, dedicated to identifying investment opportunities in the video game industry.

A wallet belonging to TreasureDAO, which was founded in 2021 to create a decentralized video game ecosystem, had the largest voting power in the Arbitrum onchain vote and voted in favor. Other yes votes came from Ethereum analytics firm L2Beat, risk management firm Gauntlet, Wintermute Governance, Princeton Blockchain Club, and @OlimpioCrypto on X.

“It’s one of the first initiatives of this size and time horizon. It’s also one of the first initiatives of its kind with a strong focus on investment, rather than just distributing grants,” wrote L2Beat’s Krzysztof Urbański nine days ago in Arbitrum’s forum discussion. “We hope this proposal (and the underlying legal structure) will lay the groundwork for other similar initiatives.”

Read More: Ethereum L2 Networks Reach Record High of 7 Million Distinct Addresses

Re-vote? Repeal?

The governance proposal passed with 162.41 million votes in favor and 50.48 million votes against. However, some want a re-vote, while others have said they’ll devote energy to a repeal.

Camelot hopes “this proposal will be addressed with either a re-vote, or specific sub proposals to fix the issues highlighted above us and other delegates who are raising questions.”

”Between the high certainty of dilution by minting 225,000,000 ARB, the low certainty of returns on investment, and the high operating costs, this proposal should fail on its merits,” GFX Labs said. “If it passes by some stroke of good luck or inertia, we and other stakeholders will consider moving to repeal it immediately if left as is.”