November 14, 2022 / Unchained Daily / Laura Shin

What’s Poppin’?

Could FTX’s Bankruptcy Trigger a Domino Effect?

FTX filed for bankruptcy after a chaotic week. Can crypto survive the contagion effects?

Bahamas Securities Commission Says It Didn’t Authorize FTX Withdrawals

A statement from the Bahamas securities regulator denying that it directed FTX to open up withdrawals for Bahamian clients has fueled speculation that FTX used an excuse to aid insiders in moving funds off the exchange.

Crypto.com’s ‘Accidental’ 320K ETH Transfer Fuels Insolvency Rumors

Crypto exchange Crypto.com says it mistakenly sent 320,000 ETH to a Gate.io wallet in the last week of October.

Serum Fork in the Works Amid Fears That FTX-Owned Upgrade Keys Are Compromised

Solana developers have deployed a fork of Serum after concerns that an FTX-owned upgrade contract may have been compromised this weekend.

Rug Pull or Exploit? $17M Drained From FLARE Token

A Binance Smart Chain-based project lost $17 million in an exit scam, according to evidence from blockchain security firms.

Binance Forms Industry Recovery to Combat FTX Contagion

Binance said it will help strong projects strapped for cash with an industry recovery fund aimed at rebuilding the industry.

In Other News… ✍️✍️✍️

- Sam Bankman-Fried built a “backdoor” to his FTX exchange to change financial records and move funds without alerting others.

- Kraken froze the accounts owned by FTX and Alameda Research on its platform.

- California’s Department of Financial Protection and Innovation (DFPI) announced an investigation into the failure of FTX.

- The Ontario Teachers’ Pension Plan had $95 million in FTX, but said it will have a “limited impact.”

- FTX spent $74 million in residential property in the Bahamas during 2022, according to government documents obtained by The Block.

- Amy Wu, a former partner at Lightspeed Venture Partners, resigned from her position with FTX Ventures.

- Crypto exchange Huobi reported $3.5 billion worth of reserves.

- Crypto.com (disclosure: sponsor of Unchained) holds 20% of its reserves in meme coin Shiba Inu.

What Do You Meme?

Recommended Reads

- The Block’s MK Manoylov on the story of NFT royalties

- Haseeb Qureshi, managing partner at Dragonfly, on what’s next for the industry

- The Information’s Margaux MacColl on Sam Bankman-Fried

On The Pod…

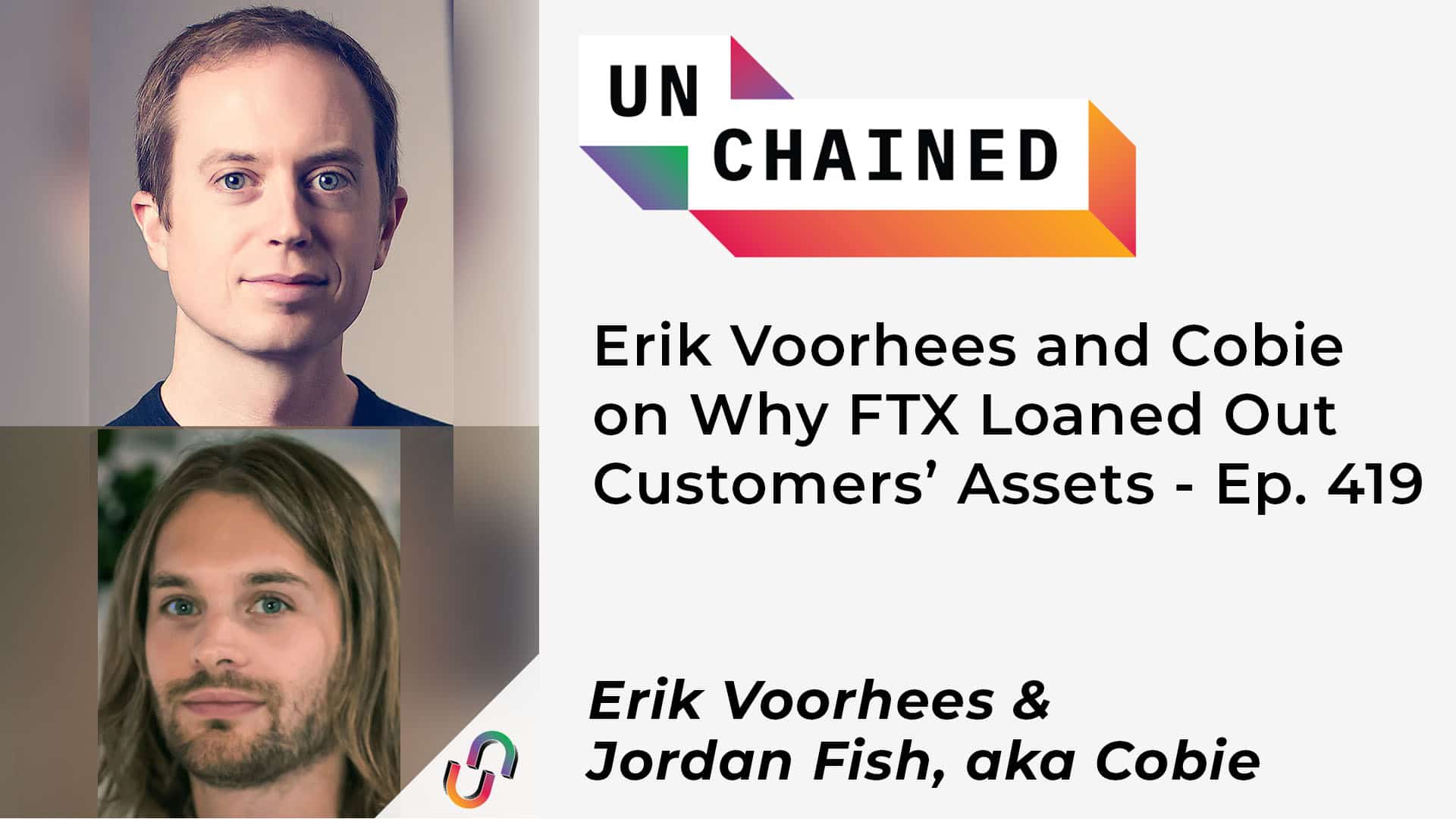

Erik Voorhees, founder of ShapeShift, and Jordan Fish, aka Cobie, crypto investor and host of UpOnly, talk about the collapse of FTX. Show highlights:

- the links between FTX and Alameda and what kickstarted the blowup of FTX

- why Erik and Cobie think that Bankman-Fried’s behavior was “sociopathic”

- why the $10 billion hole is so shocking to Cobie considering the advantages that FTX had as a company

- whether this would have ever happened if the prices hadn’t plummeted in the bear market

- why Erik believes that SBF’s donations to both political parties are bribery

- the likelihood that this will result in criminal charges

- how blockchain technology is the solution to the problem of centralized exchanges doing things in the dark

- Erik’s response to Bitcoin maximalists who say FTX was caused by altcoins

- how big the contagion could be in the industry

- Erik’s message to regulators and whether SBF was aligned with the values and the ethos of crypto

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: https://amzn.to/3CvfrbE