May 11, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Luna Foundation Guard is looking to raise $1 billion to help bring the UST peg back to the dollar.

-

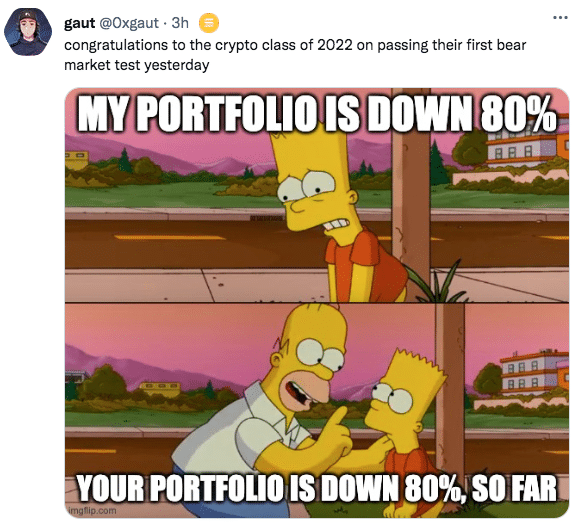

LUNA hit a low of $16.10 yesterday – marking a 79% decrease over the last seven days.

-

UST climbed to $.90 but then fell below $.75 once again.

-

Coinbase posted a $430 million loss in Q1 2022.

-

Over $1 billion in leveraged positions were liquidated in Monday’s market crash.

-

Binance restarted LUNA and UST withdrawals.

-

Bitso launched a new product in Latin America that would let customers earn yield on crypto.

-

Copper, a crypto custodian, is now offering support for NFTs.

-

Kraken is exploring support for stocks.

-

MicroStrategy CEO Michael Saylor reported that the software firm’s liquidation price for BTC is $3,562.

-

Abracadabra enabled leveraged yield farming on Stargate.

Today in Crypto Adoption…

-

US Treasury Secretary Janet Yellen highlighted TerraUSD (UST) while expressing concerns on stablecoins.

- Napster was acquired by Hivemind and Algorand.

The $$$ Corner…

-

Crypto exchange Kucoin raised a $150 million funding round that values the firm at $10 billion.

-

Beanstalk, a recently hacked stablecoin project, is looking to raise $77 million via an OTC loan.

-

Dapper Labs unveiled a $725 million ecosystem fund for Flow.

-

Crypto infrastructure firm Talos raised a $105 million Series B that saw participation from Citigroup and Wells Fargo.

-

Jambo, a web3 user acquisition platform, raised a $30 million Series A led by Paradigm.

- Katie Haun Ventures led an $11 million seed funding round for Highlight, a no-code NFT community platform.

What Do You Meme?

What’s Poppin’?

Instagram Begins NFT Testing

Instagram launched its NFT pilot yesterday. According to a tweet, the social media platform started testing NFT support with select US creators and collectors to share NFTs that they have created or bought.

Adam Mosseri, head of Instagram, is aware of the importance of the creator economy for the platform due to how income streams for creators can be unpredictable and volatile.

According to Mosseri, enabling NFTs will create new ways in which a subset of creators can earn money and make a living out of their content. NFTs allow artists, musicians, and creators to tokenize their work and verify ownership of it, helping them solve ownership issues.

“I want to acknowledge upfront that NFTs and blockchain technologies are all about distributing trust and distributing power,” Mosseri said in his announcement. “But Instagram is fundamentally a centralized platform, so there’s a tension there. So one of the reasons why we’re starting small is we want to make sure that we can learn from the community. We want to make sure that we work out how to embrace those tenets of distributed trust and distributed power, despite the fact that we are, yes, a centralized platform,” he added.

Instagram NFTs will first support Ethereum and Polygon, a sidechain-based scaling solution with very low fees. Executives hinted that Flow and Solana will be coming soon. MATIC, the native token of Polygon, went from a low of $0.79 to almost $1, pumping 25% in one day, according to Coingecko. Ryan Wyatt, CEO of Polygon Studios, said on Twitter that “Facebook chose Polygon due to Polygon’s carbon-neutral footprint, its scalability, and the developer ecosystem.”

Mark Zuckerberg, CEO and founder of Meta (formerly Facebook, for which, disclosure, I write a Bulletin newsletter),commented “Meta plans to bring NFTs to apps in our family. Similar functionality is coming to Facebook soon, along with augmented reality NFTs on Instagram Stories via Spark AR so you can place digital art into physical spaces.”

Recommended Reads

-

Forbes on UST:

-

Emin Gun Sirer, the founder of Avalanche, on algo stablecoins:

-

@zachxbt on the definition of a rug pull:

On The Pod…

Will Optimism’s OP Token Draw People Back to Layer 2s on Ethereum?

Kain Warwick, founder of Synthetix, and Ben Jones, cofounder and chief scientist at Optimism Foundation, discuss the current state of Ethereum Layer 2s, Optimism’s new governance structure, why Synthetix chose to build on Optimism, and more. Show topics:

-

what Optimism and Synthetix are

-

how zero-knowledge rollups differ from optimistic rollups

-

why Synthetix decided to build on Optimism

-

what makes L2s more enticing to build on than other L1s

-

how Optimism’s governance is going to change with the launch of the Optimism Collective and OP token

-

what issues Synthetix has had with Discord governance and early token voting, and how they have now solved this by forcing users to consolidate wallet addresses

-

what retroactive public goods funding is and how it could create a “flywheel” of development on Optimism

-

why whales might be excluded from Optimism’s token grant to Synthetix

-

why Ben thinks the future is about the “superchain” rather than multi-chain

-

what Kain and Ben think about bridging between L2s and Mainnet

-

why Optimism is a staunch backer of EIP 4844

-

how the merge could affect Optimism and Synthetix

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians