September 14, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- The US Treasury will allow American citizens to recover locked funds in Tornado Cash.

- A court in South Korea issued an arrest warrant against Do Kwon, the founder of Terra.

- BitGo filed a $100 million lawsuit against Galaxy Digital for breaking a merger agreement.

- U.S. inflation came in above estimates, and crypto prices plummeted.

- A group of Italian and international investors are suing Binance over exchange outages.

- Charles Schwab, Citadel and Fidelity Digital announced the launch of EDX, a digital asset exchange.

- After halting withdrawals, crypto miner Poolin will issue ‘IOU’ tokens to affected users.

- Crypto exchange FTX froze amid high volatility; SBF apologized.

- Justin Trudeau, the Prime Minister of Canada, attacked the opposition for recommending BTC.

Today in Crypto Adoption…

- The Linux Foundation launched an initiative to support the development of open source interoperable digital wallets.

- Investment firm KKR experimented with listing private equity investments on the Avalanche blockchain.

The $$$ Corner…

- North Island Ventures, a crypto-focused investment firm, launched a new $125 million investment fund.

- UK venture firm Northzone raised a €1 billion fund to invest in innovative technologies, including Web3.

- NFT collection Doodles announced a $54 million funding round.

What Do You Meme?

What’s Poppin’?

The Merge is Hours Away!

Tonight, the Merge is finally happening, and Ethereum will transition from proof of work to proof of stake.

The Merge is the most awaited event in crypto this year, and perhaps in the entire history of this industry. It has been said countless times that it would be impossible. That it was like changing an airplane engine mid-flight. Many laughed about the fact that it got delayed (yes, many times).

Still, we are finally here. After years of research and tests, Ethereum is ready to make the final step and enter the proof of stake era.

The event is expected to happen around Thursday 5:00 UTC. If you google “The Merge,” you’ll see the search giant has its own final countdown. The Financial Times featured the Merge on its front page. And ETHMerge parties are planned around the globe: from Milan to Mexico City, from Berlin to Bogota, from San Jose, Costa Rica, to Singapore.

“Excited about The Merge! One of the coolest examples of sustained, ambitious, technically difficult open source development,” said Patrick Collison, CEO of Stripe.

One of the immediate consequences of the Merge will be the reduction of energy consumption, making the network much more eco-friendly. The expected energy savings are around 99.98%, said Digiconomist, an account that tends to be critical of the environmental impact of crypto mining.

In the markets, from Friday through Monday, there was a lot of confidence in ETH, as the price rose significantly. However, yesterday macro news hit hard again, with inflation numbers higher than expected. This caused all risk-on assets to tank, including stocks, BTC, ETH and almost every other crypto token. As of Tuesday night, ETH was trading at around $1,600.

Still, Glassnode data shows that the seven-day moving average of exchange inflow volume and transaction volume reached a one-month high. Meanwhile, CoinDesk reported that traders are looking at four key metrics: ETH funding rates, any discount in staked ether (stETH), Ethereum Classic derivatives, and the behavior of institutional investors.

If you are holding ETH on a centralized exchange, beware that some of them are temporarily pausing deposits and withdrawals of ERC-20 tokens. Jump_crypto put a great list of what each exchange is going to do here.

Until the fork, enjoy the final hours of proof of work Ethereum. But then buckle in, because within 24 hours after, an ETHPoW fork is set to launch.

Celsius CEO Has a Plan to Revive the Firm

According to a leaked recording, Celsius CEO Alex Mashinsky is pushing for a revival of the firm.

Celsius filed for Chapter 11 bankruptcy in July citing liquidity issues. It is one of the many companies that collapsed in this crypto bear market, among Three Arrows Capital and Voyager Digital. Users of the platform still have millions of dollars frozen in the lender’s accounts.

According to the NYT, Mashinsky held a meeting last week with employees, in which he outlined a plan to revive the firm. The plan, which is named Kelvin (after the unit of temperature ~ like Celsius), is to rebuild the company with a focus on crypto custody and charging fees on certain types of transactions.Mashinsky compared his firm’s bankruptcy to Pepsi and Delta. “Does it make the Pepsi taste less good?” he asked employees. “Delta filed for bankruptcy. Do you not fly Delta because they filed for bankruptcy?”

On this comparison, bankruptcy expert Thomas Braziel argued, “yeah but Delta is not a financial firm that operates of faith/trust – that’s the big difference between financial and non-financial Bks.” Braziel seems to have disliked the plan. “What a joke – come on Mashinsky can you please do the right thing, step down,” he added.

The plan hasn’t been confirmed yet, and even if it did, it would require approval by Martin Glenn, the federal judge in New York who is overseeing the bankruptcy process.

Mashinsky has reportedly been working with the creditor committee to put the plan forward. However, a source told NYT that the committee has serious concerns about Mashinsky’s involvement with the company and his newfound plan.

Celsius has to continue to go through its bankruptcy process, and a hearing will be held tomorrow to decide whether to redact information about Celsius creditors.

Yesterday two lawyers from the Federal Trade Commission requested permission to represent the regulator in Celsius’ bankruptcy case.

Recommended Reads

- Vishal Chawla on Ethereum censorship resistance post-Merge

- Youssef Amrani on Ethereum and Cosmos

- MT on what’s next for Ethereum

On The Pod…

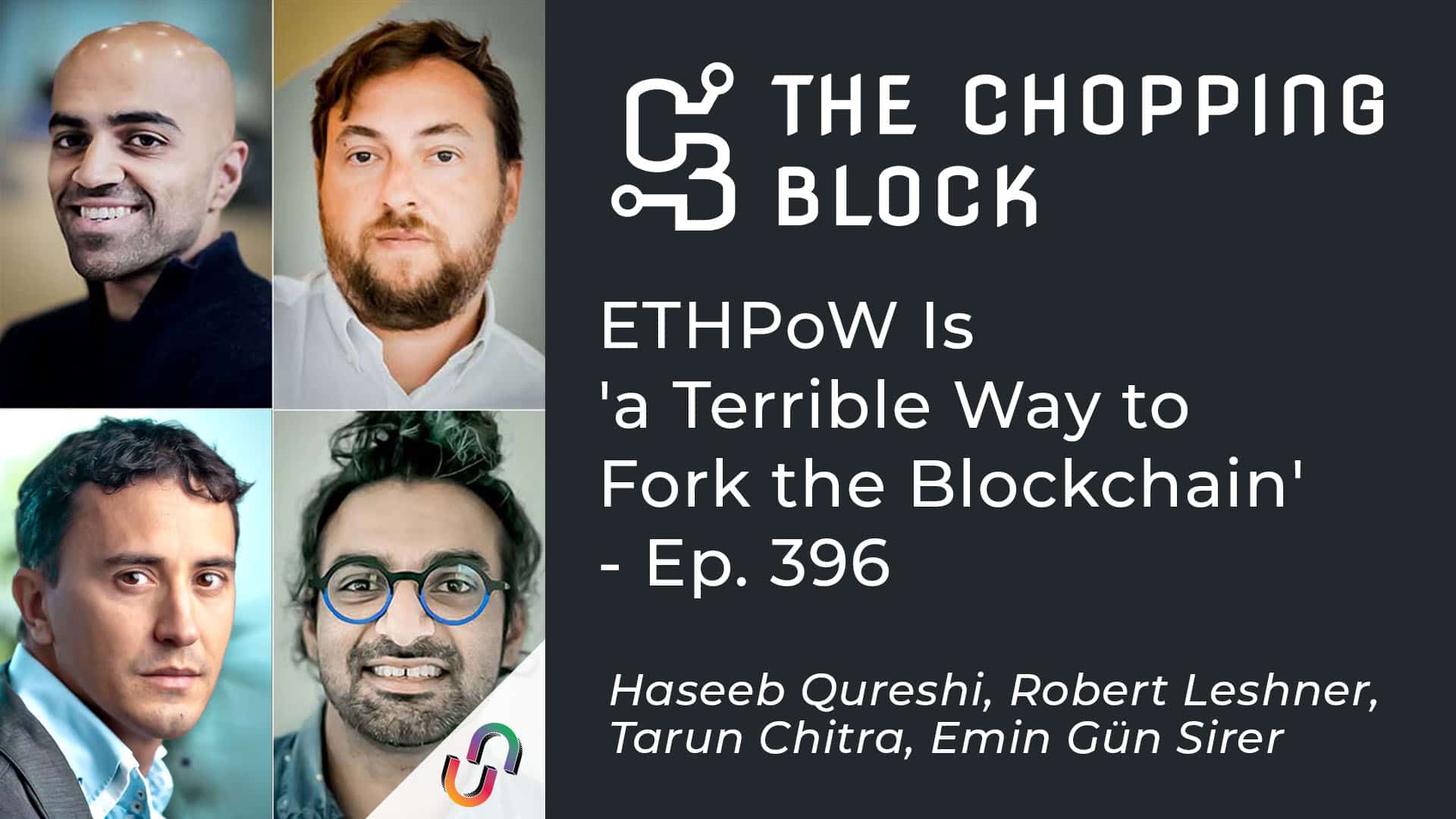

Welcome to The Chopping Block! Crypto insiders Haseeb Qureshi, Robert Leshner and Tarun Chitra chop it up about the latest news in the digital asset industry. In this episode, Emin Gün Sirer, the emperor of Avalanche, also joined the conversation. Show topics:

- Gün’s take on the Ava Labs conspiracy story and whether there was any truth in the videos

- The impact of the Merge on ETH issuance and energy usage

- What’s going on with the ETHPoW fork, and how the team has been messing up

- The TL;DR of the technical side of Ethereum scaling, explained by Tarun

- What Ethereum miners are going to do after the Merge

- Whether Coinbase’s support of the lawsuit against the US Treasury over Tornado Cash was a PR move

- How this moment in history resembles the ‘90s and the rise of the internet

- How FTX and Coinbase have different approaches to regulation

- How would everyone celebrate a successful Merge and whether there’s a chance of it failing

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians