November 9, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Digital asset investment products saw an inflow of $174 million last week, marking the 12th week in a row of inflows.

-

Cryptocurrency, as an asset class, hit a $3 trillion market cap.

-

Coinbase wallets are now available via a browser extension.

-

BlockFi and Neuberger filed with the SEC for a spot bitcoin ETF.

-

Michael Hsu, acting head of the OCC, warned against too much innovation in the stablecoin industry.

-

Chatex, a cryptocurrency exchange, was added to OFAC’s list of sanctioned companies for allegedly facilitating ransomware payments.

-

Brave, the crypto privacy browser, is adding native supportfor Solana wallets.

-

OpenSea crossed $10 billion in total volume.

-

Nigeria’s central bank is shutting down accounts of suspected crypto traders.

-

Five million Robinhood customer emails were stolen in a data breach.

-

Uniswap is attempting to rebrand with an emphasis on visually distinguishing the protocol from the development team.

- Zimbabwe is reportedly consulting with the private sector regarding making Bitcoin a legal payment system.

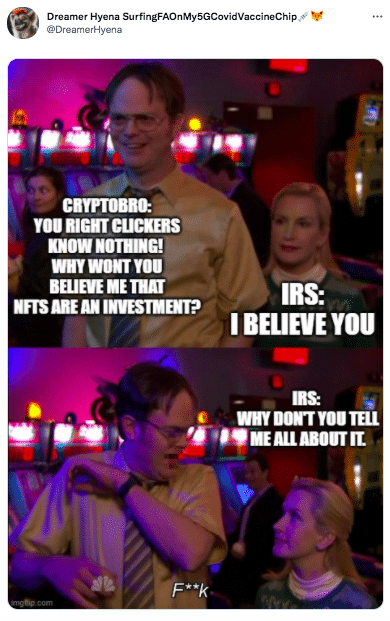

What Do You Meme?

What’s Poppin’?

In a press release yesterday, Mastercard announced a partnership with three cryptocurrency companies in the Asia Pacific region to launch crypto-backed payment cards in the area. The payment company’s trio of partners includes Amber Group, CoinJar, and Bitkub.

With the launch, Mastercard customers can now apply access to credit, debit, and pre-paid cards. The cards will be crypto-linked, enabling customers to convert cryptocurrencies into traditional fiat anywhere that accepts Mastercard as payment.

“Cryptocurrencies are many things to people—an investment, a disruptive technology, or a unique financial tool. As interest and attention surges from all quarters, their real-world applications are now emerging beyond the speculative,” said Rama Sridhar, Executive Vice President, Digital & Emerging Partnerships and New Payment Flows, Asia Pacific, Mastercard, in the statement.

Mastercard’s decision to support crypto payments in the Asia Pacific region is the third such cryptocurrency adjacent-move the company has made since its February blog post declaring, “Mastercard will start supporting select cryptocurrencies directly on our network.”

Following the blog post, Mastercard acquired CipherTrace, a blockchain forensics company, to enhance Mastercard’s “crypto capabilities” in September. And, In October, Mastercard announced a similar partnership with Bakkt, which would allow US merchants and banks to build cryptocurrency into their offerings.

Recommended Reads

- Mario Gabriele on Discord:

- Venkatesh Rao, a writer for Ribbon Farm, on his web2 → web3 experience:

- Galaxy Digital Research on layer 1s:

On The Pod…

NFCastle 2021: Art Controversy – NFTS: Nothing F**king There?

At Non-Fungible Castle 2021, an NFT exhibition in Prague, four NFT experts debate some of the hottest topics in the metaverse, like how to value NFTs, whether insider trading exists, what makes Ethereum-based NFTS so special, and the environmental impact of NFTs.

Guests include Maria Paula Fernandez, co-founder at JPG, Kavita Gupta, cofounder of FINTECH.TV, Oliver Halsman Rosenberg, artist, and gmoney, an NFT collector. Show highlights:

- what an NFT is

- why NFTs have value

- what the “myth of decentralization” has to do with NFT valuation

- why collectors like gmoney prefer to collect NFTs on Ethereum vs. other chains

- how provenance and IP rights interact with value

- why gmoney thinks Solana Punks are like fake Chanel bags

- what “owning an NFT” actually means

- whether newbies need to be protected from buying scam NFTs

- the “rite of passage” of falling pretty to a rug pull and the concept of “do your own research” (DYOR)

- what can be done about insider-trading-like activities in NFTs

- how to navigate public-facing blockchains when your address is doxed

- different ways to link off-chain assets to NFTs

- what the crypto industry can do to better understand the NFT impact on climate change

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians