September 30, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Business Insider reports Sam Bankman-Fried was potentially interested in buying Twitter; their last exchange was Musk texting SBF, “Sorry, who is sending this message?”

- Voyager Digital counsel filed an order to authorize the sale to FTX US.

- New legislation introduced by three congressional Republicans aims to include crypto in 401(k) plans.

- Judge Martin Glenn approved Shoba Pillay as an examiner for the Celsius bankruptcy case.

- Texas state agencies opposed the Celsius plan of selling off stablecoin holdings to continue day-to-day operations.

- A Cryptopunk sold for $4.5 million despite the bear market.

- Crypto exchange Crypto.com (Disclosure: sponsor of Unchained) was targeted by the hacking group Lazarus.

- Famous short seller Jim Chanos called crypto a “predatory junkyard” and raised concerns about Coinbase.

- NFT marketplace X2Y2 hit back popular NFT project QQL, a day after QQL prohibited its holders from interacting with the protocol.

- Citadel Securities’ founder Ken Griffin said that people leaving NFTs and other cryptos is good for the American economy.

- Crypto exchange Binance started operating an ETH Proof of Work mining pool.

- Crypto exchange Gemini submitted a proposal on the MakerDAO forum to increase the adoption of its stablecoin GUSD.

- Aurora, an Ethereum scaling solution, paid out $2 million in bounties through the ImmuneFi platform.

Today in Crypto Adoption…

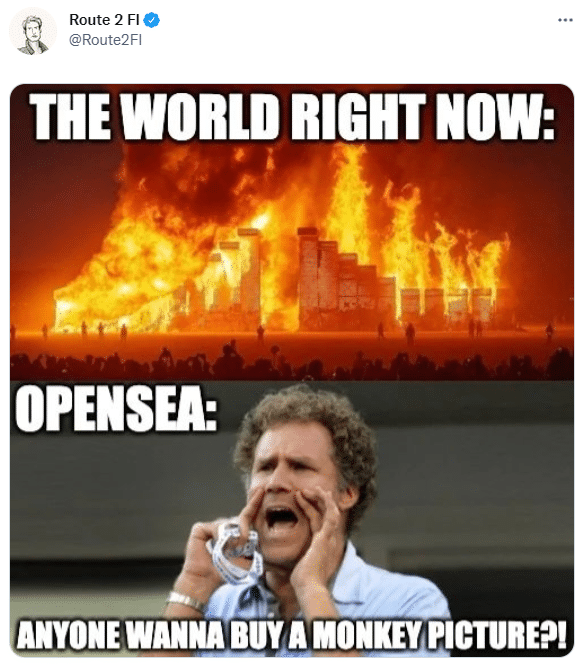

- Warner Music Group announced a collaboration with NFT marketplace OpenSea.

- Meta (Disclosure: I write a Meta Bulletin newsletter) enabled users in the US to post digital assets on Facebook and Instagram.

- Blockchain analytics firm Chainalysis (disclosure: sponsor of Unchained), reported mass crypto adoption in Sub-Saharan Africa.

- BlackRock, the world’s largest asset manager, launched an ETF in Europe with exposure to blockchain and crypto companies.

The $$$ Corner…

- Bitcoin mining firm Rhodium is going public after merging with SilverSun Technologies.

- Cardano development lab Emurgo plans a $200 million investment to boost the ecosystem’s growth over the next three years.

- Index Ventures led a $3.5 million round for two former Revolut employees, who are building a crypto investment app.

- Aikon, a multi-chain onboarding platform, raised $10 million in a Series A round led by Morgan Creek Digital.

- Circle acquired payment services firm Elements to scale its own offerings.

What Do You Meme?

What’s Poppin’?

Several Developments Address the Securities vs. Commodities Debate in Crypto

As the question of whether crypto tokens’ default regulator should be the Securities and Exchange Commission or the Commodity Futures Trading Commission drags on, this week saw at least a few movements toward resolving that question.

The Block obtained a draft bill introduced by Republican Senator from Tennesse Bill Hagerty that could give crypto exchanges a two-year legal grace period if the SEC determines that they listed a security.

The two-year period would commence at the moment the SEC determines that a token is an unregistered security.

If the SEC decided to label tokens as unregistered securities, the proposed legislation would give the CFTC the right to object to that decision.

The bill comes recently after the SEC alleged that Coinbase listed nine tokens that the SEC believes are unregistered securities.

Speaking of exchanges that had listed securities, yesterday the SEC suffered a setback in its case against Ripple about an alleged unregistered securities offering.

US District Judge Torres denied the Commission’s request to shield documents related to a 2018 speech in which Bill Hinman, former Division of Corporation Finance Director, said that ether was decentralized and therefore sales of ether were not securities transactions.

Ripple’s victory would likely force the SEC to reveal its reasoning behind that determination.

Meanwhile, CFTC Chair Rostin Behnam continues to push for the CFTC to be the lead crypto regulator. On Wednesday, he said that Bitcoin could “double in price” if it traded under its regulation.

This was a turbulent week in terms of enforcement actions by regulators, as the CFTC filed charges against a DAO, and the SEC initiated a lawsuit against Hydrogen for market manipulation.

On a related note, the European Parliament is reportedly working on a draft bill targeting DeFi, NFTs and the Metaverse. Under the terms of the bill, Web3 companies would have to carry out anti-money laundering checks on its customers.

Recommended Reads

- Marina Lammertyn on the impact of crypto in Latin America

- Treehouse on blockchain interoperability

- Haun Ventures’ study on Web3 voters

On The Pod…

Nikhilesh De, CoinDesk’s managing editor for global policy and regulation, comes to talk about the CFTC lawsuit against Ooki DAO and the potential consequences across the crypto industry. Show highlights:

- the enforcement action against Ooki DAO and the CFTC’s arguments behind it

- whether bZx’s statements that the DAO would be beyond the reach of regulators made it a target for the CFTC

- whether the broader implication of these charges could mean that all DeFi is illegal

- whether the hacks of bZx made it a high-profile target

- the CFTC Commissioner Summer Mersinger’s dissenting statement and her concerns

- who the targets of the CFTC enforcement action are

- the consequences of the lawsuit for token holders and how to determine which token holders are liable

- why the CFTC chose to post a notice in the Ooki DAO forum and whether that is sufficient notice

- what the next steps for DAO members are and whether there will be wide community support

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians